The Silver To Gold Ratio

It's approaching time to consider converting your Silver to Gold

This is the fun of the game.

And it is a game.

This - is the joy I get from investing.

Watching the horizon for threats and opportunities - Meerkat style.

Reversion to the mean is a natural phenomenon that occurs time and time again. Something high will go low and the low will go high.

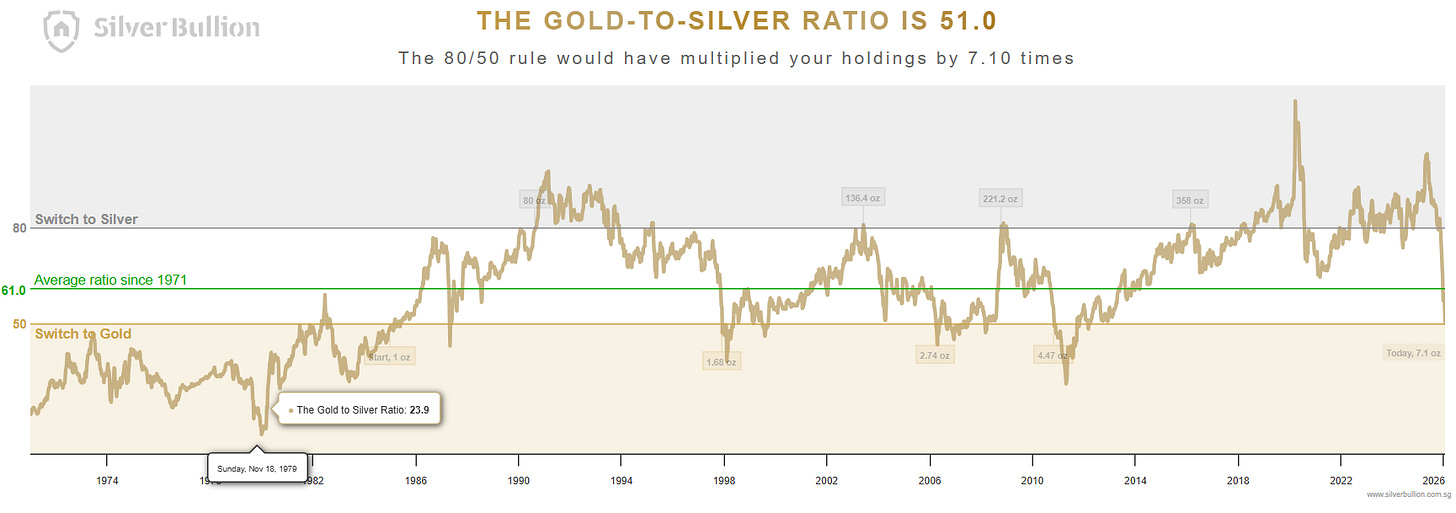

Now look at the Silver/Gold ratio above (30 year chart). As of very recently it was very high. However it has been reverting to the mean.

Saying it other ways:

If you could exchange Silver for Gold at no cost of transaction, now would be a sensible time to consider starting to rebalance from Silver to Gold for a portion of your portfolio

If you were considering buying Gold OR Silver, you would likely pick Gold

Approaching the Threshold

SilverBullion.com has a really nice chart for the visually inclined. It says here that the current ratio is 51.0 and average since 1971 is 61.0.

At the top there it says “The 80/50 rule would have multiplied your holdings by 7.10 times”. Effectively flipping your Gold to Silver at the top (> 80) then flipping Silver to Gold at the bottom (< 50) would multiply your store of value. (This would be you flipping your entire stack).

The colored bands are very helpful the top is Silver and the bottom is Gold.

So we’re drawing upon this time period. We’re not in it - but coming close.

Barrier To Entry

A key to being a good investor is looking for barriers to entry.

Hard things are hard.

This is what separates the wheat from the chaff - the barrier to entry.

The feeling of risk, having to go out of your way. Having to figure things out. Things not feeling perfectly smooth. Having to research. These are all signs of a barrier to entry and by paying admission through a barrier of entry - you get to ride the ride.

Most people wont ever be aware of a barrier to entry. If they are aware they aren’t willing to go through it.

What I’m saying is positive outcome actions on your portfolio that are meaningful always will have a degree of discomfort.

Epochs

Now this statement is based off this 30 year chart. However one could argue that this may not be the correct window to analyze the ratio.

Truthfully, we’ve seen a few different epochs of the Gold To Silver Ratio. I’m no Gold Bug - but I’m vaguely aware that these numbers were much closer together in ancient times I believe somewhere around 10-15:1. Then during times of stability when a Gold Standard was used, you can roughly generalize the ratio at 30:1. Then post Gold Standard times you are looking at 60-70:1.

Math

When it comes time - let’s see how that would look like from a math point of view.

Now the goal would be to swap our Silver for Gold.

If you want to keep some Silver for smaller denominations of value, that is fine. This might be for Shit hits the fan scenarios.

The idea would be we are looking at moving all non Shit-hits-the-fan bullion from Silver to Gold.

To keep things scoped and simple, lets deal with 1 oz coins - Canadian Maples for example.

How many 1oz Silvers do we need to give up to get a single 1oz Gold?

Looking at a local Bullion Dealer’s website they are charging a premium of 1.76% above spot price for gold and 6.16% above spot for Silver. They also have prices for selling which are under spot.

So they make their money on the buy and the sell.

When I calculate how much I’d lose on selling the Silver and how much I’d be “losing” on buying the Gold its effective dollar value is equivalent to 4.16 pieces of silver.

Or said another way -

I’d be losing 4.16 pieces of silver to get a piece of gold

This makes it intuitive to visualize what I’d need to see to come out ahead.

So if i exchanged at 50:1 - it would simply be the Gold/Silver ratio going from 50:1 to 55:1. Then I’d be at the break even point.

Months ago I setup a tranche system to swap out pre-determined portions of silver for gold, starting at a GSR of 75. Basically, I set aside a fixed amount of silver that, when the GSR hit a specific band, to sell without emotion.

The portion was predefined to buy a certain amount of gold at that level, fully knowing the dealer spread when the market compressed (so a purchase at 75, for example required about 80, etc.).

Rather than a large scale liquidation all at once, I divided each tranche such that I would make one liquidation at a level per month, and if the GSR dropped to a lower tranche, only then to liquidate the full portion of the higher tranche for gold. So for example, if you allocated 195oz of silver to swap for at 65, 1 Oz per month's over 3 months, and in the first month the GSR dropped to 55, you would swap the full 195 Oz for about 3.5oz of gold instead.

This is how you ride out the volatility to not liquidate your full position too soon, holding portions to from, say 75 down to 1.

This time staggered strategy is to account for the whipsaw effect which is brutal for silver (GSR going from 75 to 100 in a few weeks). To counter this, each unit of gold I swap for, I physically write a note to swap back for silver at my swap price + 15. So for a piece of gold I swapped from 80 Oz of silver, I hold until there's a whipsaw correction to 95 to swap back for silver, and do that for each piece of gold, swapped at each tranche.

I think the odds of silver going 1 to 1 with gold are not zero. If there is a short squeeze in the futures market, companies like Tesla, OpenAI, and anyone who deals with any greentech or microchips will have to buy silver at any price to avoid manufacturing shocks that will cripple their businesses, so personally, I think it's a good idea to hold some silver for the potential eventuality that silver overshoot the historic GSR and corrects to a level unseen in history.

The inverse happened during the COVID years, when the GSR hit 120.

That made absolutely no sense mathematically, and I bought a sizeable portion of my position at that level.

For that reason, I'm holding out a large tranche for the possibility of the GSR at 15, 5, and 1, but have been locking in some profit by swapping smaller amounts at current levels.