What Is Value?

During my 20’s I was trying to figure out how to become rich - so I “could be happier”. I was trying to figure out the patterns of why and how wealth accumulates.

After I first started poking at “where does money come from?”, I soon after realized it was a store of value.

So then - what is value?

The starting point to figuring all of this out is a go-to of mine - A thought exercise.

Einstein famously came up with the Theory of Relativity using the same techniques of producing a mental sandbox, free from the constraints of reality and physics. In this sandbox, you act as the creative director, shaping the scenario however fancifully as you wish.

OK - sandbox initiated.

Following Occam’s Razor and First Principles Reasoning the best place to start is with simplicity and only few variables.

Imagine if you will -

A small desert island in the Pacific with a shipwrecked inhabitant. They washed ashore with an accompanying crate. In the crate, all the granola bars you could ever wish for. Starving, he devours 5. Feeling satiated, he falls asleep in the sun.

A few days later another survivor is washes up on the island. While he is coming to his senses, he finds a crate of bottled water. With an unquenchable thirst, he rips open the crate and drinks from a few bottles. All is good.

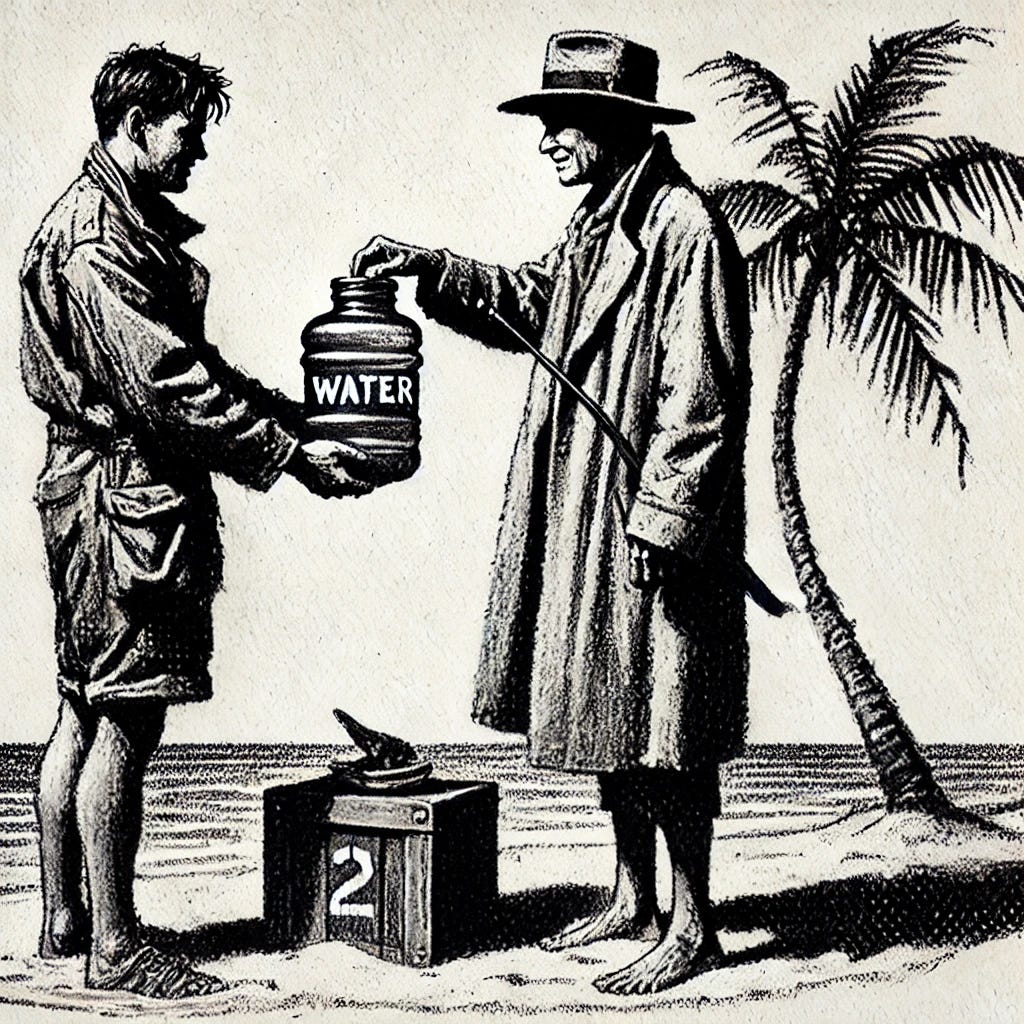

A few days of exploration later and the two bump into each other. Mr. Food hiding his granola bars and Mr. Water hiding his bottled water.

Mr. Food longing for a cool drink would do anything for a sip of even lukewarm water. And Mr. Water would kill for some food - his stomach is rumbling.

To Mr. Food, the granola bars stuffed in his pocket are worth less to him at this point in time than the water bottles. To Mr. Water, his bottles were worth less to him than the food in the other guys hand.

They talk, agree on an exchange and make a trade.

💥At the moment they exchange goods - Value is magicked into existence💥

Let’s freeze frame this moment and analyze what is going on.

This scenario required a key ingredient to occur -

2 distinct consciousness

The distinct consciousness - are the two different people. They each have unique outlooks, thoughts, histories, beliefs, value systems and resources. Without there being two of them there would not be two different perceptions.

When we say value, quite often we should be saying perceived value. Similarly, when we say intrinsic value, quite often we should we really be saying perceived value.

Beauty is in the eye of the beholder.

Everyone perceives things to be of different value depending on many factors. These two gentlemen could put high perceived value on food, or water or none at all depending on the variables. With 1 consciousness, there no difference in perception as to value. The same person will have the same opinion about food vs water. The only time we can convert potential value actual value is upon an exchange.

When you think about it, if you have lots of something, the value you place on each item diminishes. This is called marginal utility. The more you have of something the less perceived value you have of it.

If I were to try to create a formula for Value - my guess may be something along the lines of:

where marginal utility can be considered a factor of Perceived Value.

With Barter, value seems to be simultaneously created and destroyed in the blink of an eye. Value occurring, doesn’t manifest beyond the two parties involved. No one else gets to benefit from this exchange. No one the wiser.

Things start to get interesting when a bottle of water is exchanged for a coin. Or a granola bar is exchanged for a coin.

A coin being a universal abstraction of a store of value. The limitations of perceived value stop abruptly with the transmogrification of perceived value into abstract value. Everyone is happy to take the coin.

Barter relies on “coincidence of wants” where two people at the exact point in space and time want something that the other has. Rare, unlikely and definitely not scalable.

After close to twenty years thinking about the subject, it has been interesting to dig down into economics and think in these strange metaphysical aspects. One of the key points of intrigue for me was that when you ask people “what is money”, the thing they all aspire for, think about, talk about - no one can answer you.

This post reminded me of this video I watched over a decade ago.

I think you might enjoy it:

https://youtu.be/Yb-wM_SAX30?si=3K4VDeHhwa9NUkUW

There is one very important variable from your equation that most people miss, which is why most people can't answer the question: "What is money?"

Counterparty trustworthiness.

In your island example, before Mr. Food and Mr. Water engage in a barter transaction, both must market their product to one another and establish enough trust for a mutual, voluntary exchange to occur.

Both parties must believe that the other is acting in good faith—that they are not lying, not misrepresenting their goods, and will not use force to seize the other’s resources.

If either Mr. Food or Mr. Water defaults on their obligation, the exchanged commodity becomes worthless to the opposing counterparty, and future transactions between them become either impossible or more costly due to lack of trust.

Trust is accumulated through repeated transactions, meaning that a single breach of trust can permanently reduce or eliminate the value of future exchanges. In a low-trust environment, economic activity declines as counterparties either refuse to trade or demand costly enforcement mechanisms.

Expanding this analogy to a monetary economy, there is an additional layer of trust that factors into the value calculation of each transaction: trust in the medium of exchange itself (money).

Fiat money does not derive its value from intrinsic worth but from institutional trust.

Governments enforce its use by requiring taxes to be paid in it and by maintaining legal and economic stability. This state-backed mandate reinforces trust in the currency’s value and ensures its continued use in economic transactions.

However, when the government defaults on this obligation—whether through excessive money printing, fiscal mismanagement, or political instability—trust in the fiat currency erodes. As people lose confidence in its ability to store value, they seek alternatives, causing inflation, depreciation of the currency, and a breakdown in its role as a stable medium of exchange.

As I've said before, we live in a time where everyone is lying to everyone all the time about everything and (most importantly) NO ONE CAN TRUST ANYONE WITH ANYTHING, hence the value of things procured through low-trust transactions (such as wages for skilled labor) goes down, while things procured in high trust transactions (such as crypto-currencies and durable hard commodities) goes up.