📠The Value of Complexity

Featuring the Great Taking, Government and Investors

About

This article will talk about why complexity can be considered valuable when the alternatives open these risks:

🔴 The risks of Securitization/Tokenization

🔴 The risks of Monopolies

🔴 The risks of Trading and how Connectivity affects it

🔴 The risks of Large Price Swings

🔴 The risks of Competition

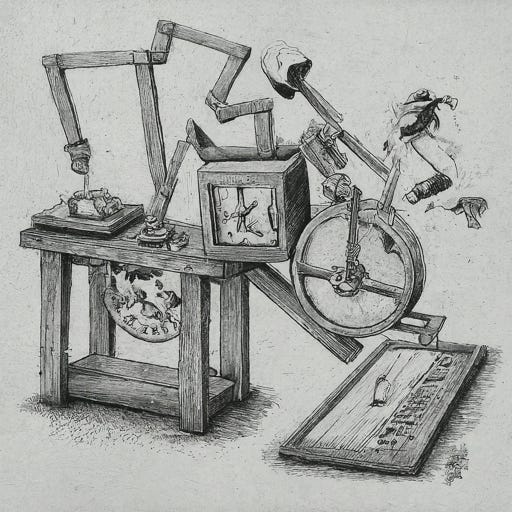

Hurdles, Air Gaps, Law Differences, Language Differences, Accounting Differences, Opaque, Processing Time, Complexities, Illiquidity, Lack of Visibility, Cultural Differences, Barriers to Entry.

Superficially they may seem like bad things or things that need to be addressed through technology. My brain wants to selfishly solve these inefficiencies for the betterment of the human race. Things should be faster, better!

Looking at these pain points from a different angle - you have Heterogeneous systems. Systems that don’t really work well together and are far from optimal. Its like pouring molasses in on one side and patiently waiting for it to come out the other side.

As I’ve gotten older, I’ve realized:

there is value in these inefficiencies.

📝Securitization/Tokenization

This is the process of creating a digital equivalent of an underlying physical asset, such as the “paper market” for gold.

I’ve heard various estimates of the size of the paper market for gold and its something like 100x the amount of physical gold. So if 100 people went with their slip of paper to get the piece of gold, 99 would walk away empty handed.

Once an asset becomes ledger based or token based, it becomes a much easier attack point for bad actors. An example that come to mind is:

If an options and/or futures market exists for an asset, Governments with their ability to print infinite free money can sell naked short options depressing the future perceived price.

🧐Monopolies

One market, one ruleset.

In this market, government and law makers (not us) can write whatever rules they fancy. If you haven’t exposed yourself to it yet - I highly recommend you read up on The Great Taking. Due to assets being conveniently in one place, represented conveniently in a “spreadsheet” it’s pretty easy to move things around.

I don’t love the Prefix of “The Great” as it can easily be cognitively grouped in with Conspiracy theories, WEF etc - however the information is all there - go digest it.

I recommend reading some commentary on it as the source is pretty dry reading.

The Great Taking - Explained Differently

🤖High Frequency, Algorithmic, AI Trading

When assets are in a digital form, they are open to interaction from computer systems. As connectivity increases and assets become digitized, it becomes viable for:

High Frequency

Algorithmic

AI based trading.

For these reasons:

I don’t trade. I just long term buy and hold.

Said another way - by trading, you are competing with fiber optic connections straight into the exchanges, hundreds of millions of dollars of compute power, PhD academics and more importantly - purpose built Artificial Intelligence. No chance.

💹Prevent Large Price Swings

The ease of manipulation through efficient systems means that large volumes of trades can occur in a short period of time.

With time, probably most investors will switch from a wealth growth strategy to a wealth preservation strategy. Large price swings and drawdown aren’t a thing for people with wealth preservation on their minds.

👨👩👧👦Average Joe Will Invest

When things are easy, the Average Joe comes in.

Average Joe can buy an asset when he is sipping a Margarita in Mexico in a click on his phone. Average Joe doesn’t know about things that are obscure and not discussed by mainstream media. Even if he does know about them, his friends aren’t investing in that opportunity. Even if he tries to invest in the thing with a high barrier to entry, he gets discouraged as it is too much effort.

You, the Illustrious investor, find out all the barriers, relentlessly push past the hurdles, have the conviction to do what others aren’t.

Summary

In summary, investing in areas that are Complex to get to can shield you from downside risk and can offer more opportunity due to the lack of competition.