The Performance of Gold and Oil

I wanted to talk about Gold, Oil and their price going forward.

I wrote back in May 2024 about moving a sizable chunk of my networth into Gold and Silver. I bought both in physical and via the stock market.

The main thesis was that the following will push Gold up over the next 2 decades:

The looming and predictable bankers wars

Central Banks have been buying hand over fist

The Fiat system is coming to the end

Commodities have been underpriced for a long period of time

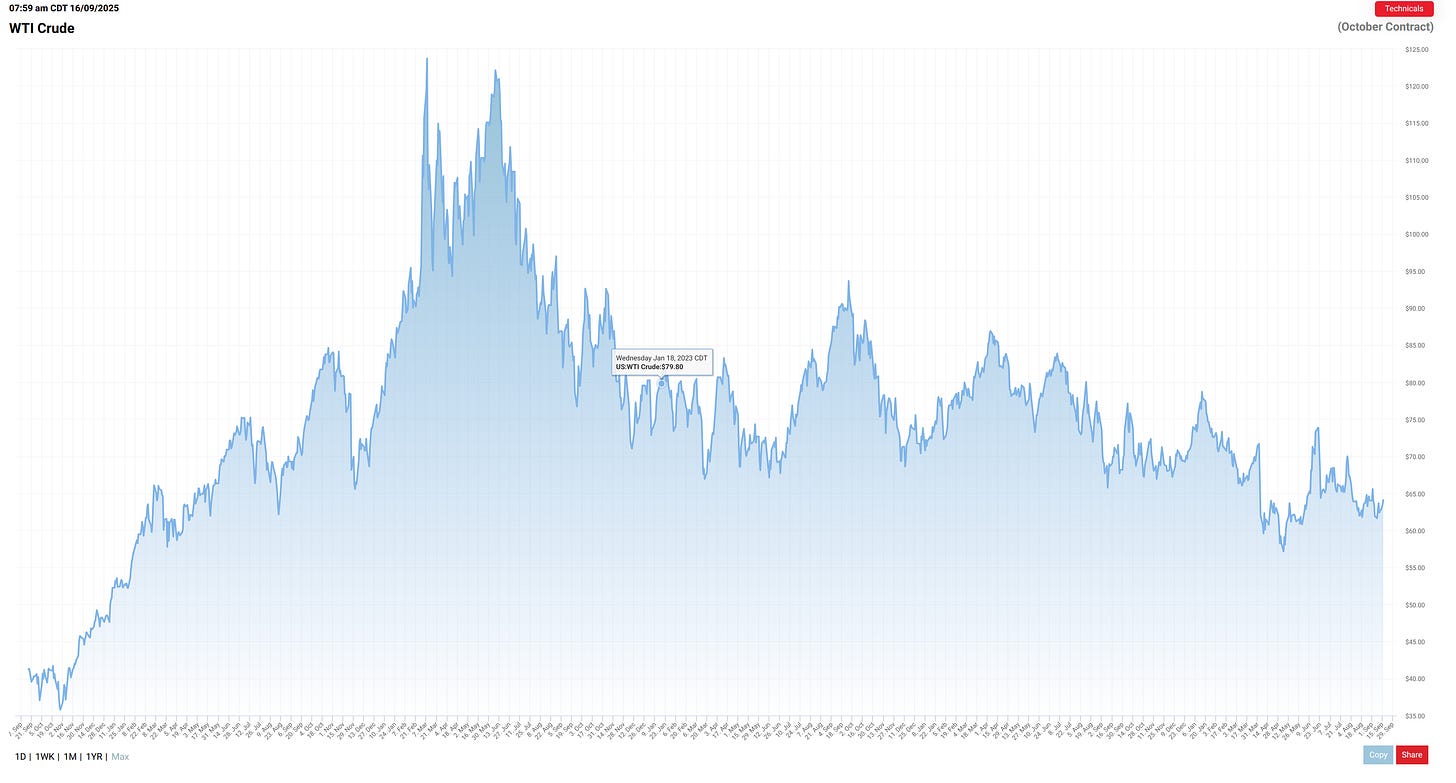

This is the price chart for the last few years.

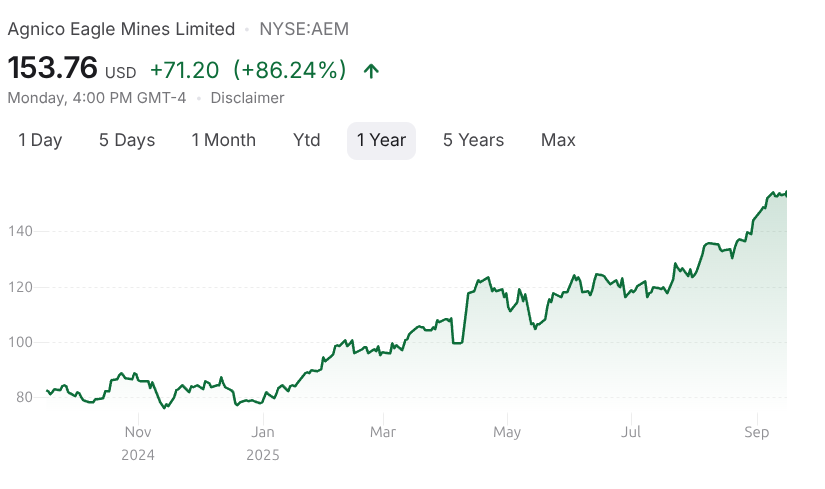

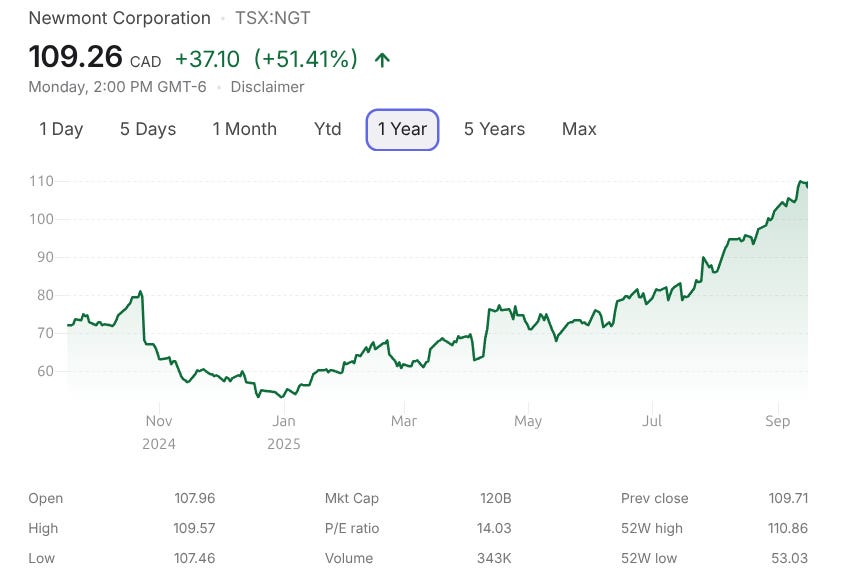

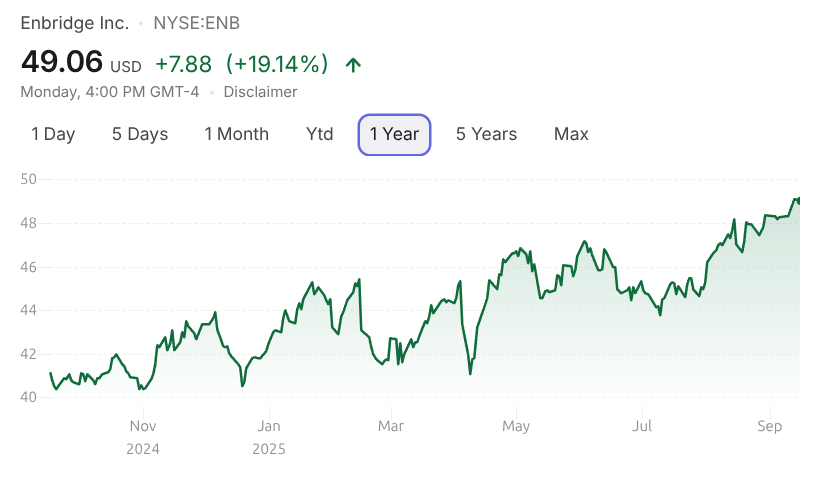

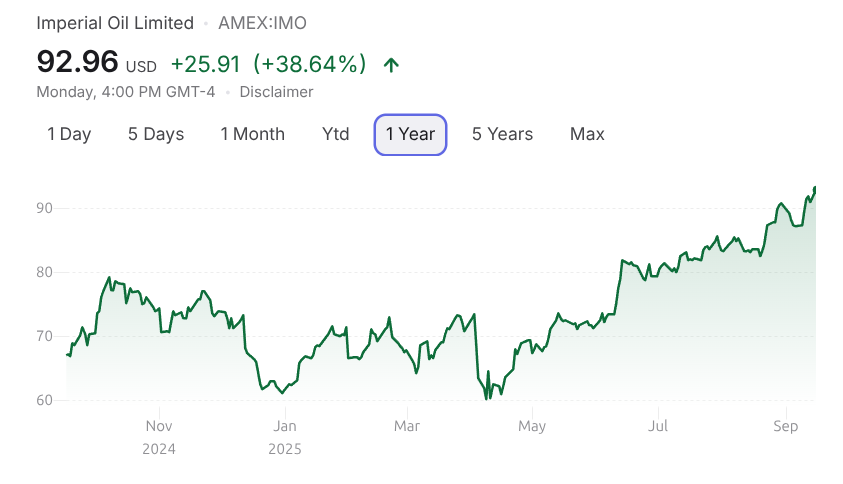

Here are the stocks I bought back at the end of 2024. I was buying pyhsical before that point.

Gold/Silver

Oil

Oil stocks haven’t moved much.

To be a good investor you need to be right on two things at the same time.

The right idea

The right time - not too early, not too late

Then once you are in a position, work towards increasing conviction (or disproving it).

Now comparing that statement to WTI Crude, you can see that I acted too early. We really want to be able to confirm a change in direction before executing that transaction.

I believe Oil is still a logical place to invest as wars require fossil fuels. I don’t know for sure which war that would be first, but there are so many that could spark. Israel vs Iran, Europe vs Russia, China Vs Taiwain & USA.

Long Term

I would be happy to hold Gold and Gold Stocks for another 1-2 decades and still feel this is a good point to accumulate.

If you have a rock hard stomache (and are a little bit crazy) check out ZSL and AGQ.

They're double leveraged silver ETF's, ZSL shorts, AGQ goes long.

I don't trade them (anymore), but silver especially is such a volatile commodity and those ETF's double the volatility.

I had a simple algorithm that, in theory should have worked very rapidly if you had the discipline (and stomach) that could make a lot of money that I never could fully implement that maybe you could have better luck with than me.

When the spot price of silver tops the 200 day moving average, sell AGQ and buy ZSL to short silver.

When the spot price drops below the 200 day moving average, sell ZSL and buy AGQ to go long silver.

The thing about those ETFs is they can have daily 20-30% moves and if you blink you can miss your buy/sell opportunity.

Instead of trading them, I set them as notifications though for when to accumulate more physical.