The Importance of Deflation in an AI Future

I’ve mentioned there are 2 paths ahead of us. An AI fuelled “Industrial Revolution” or World War 3. In this post I’ll examine the scenario of - if we ended up with the AI fuelled GDP revolution.

The future holds a very different looking picture for jobs and employment - I strongly suspect a huge increase in job losses with time. Metrics such as Revenue Per Employee will be a staple in business conversation. Organisational structures would likely end up with a handful of decision makers and AI agents doing their bidding. Given time, AI directors, CXX and CEOs will be a thing. Potentially Decentralised Autonomous Organisations (DAO) run by AI and resources stored as cryptocurrency.

Jobs are going and AI is coming.

This structure will be extremely hard for society to adapt to - I know first hand how this feels as I am experiencing it in the job market as a direct result of competition including AI competition.

People will be lost for purpose and more importantly during this transitional period - lost for income. It is important for individuals to build up a large buffer of resources to weather this period of being in the doldrums.

Deflation - A forgotten concept

We are well accustomed with inflation. It’s all you will hear about on financial news.

The US Federal Reserve has 2 mandates. One of them is purely about controlling price and that boils down to creating inflation and keep the rate of inflation steady.

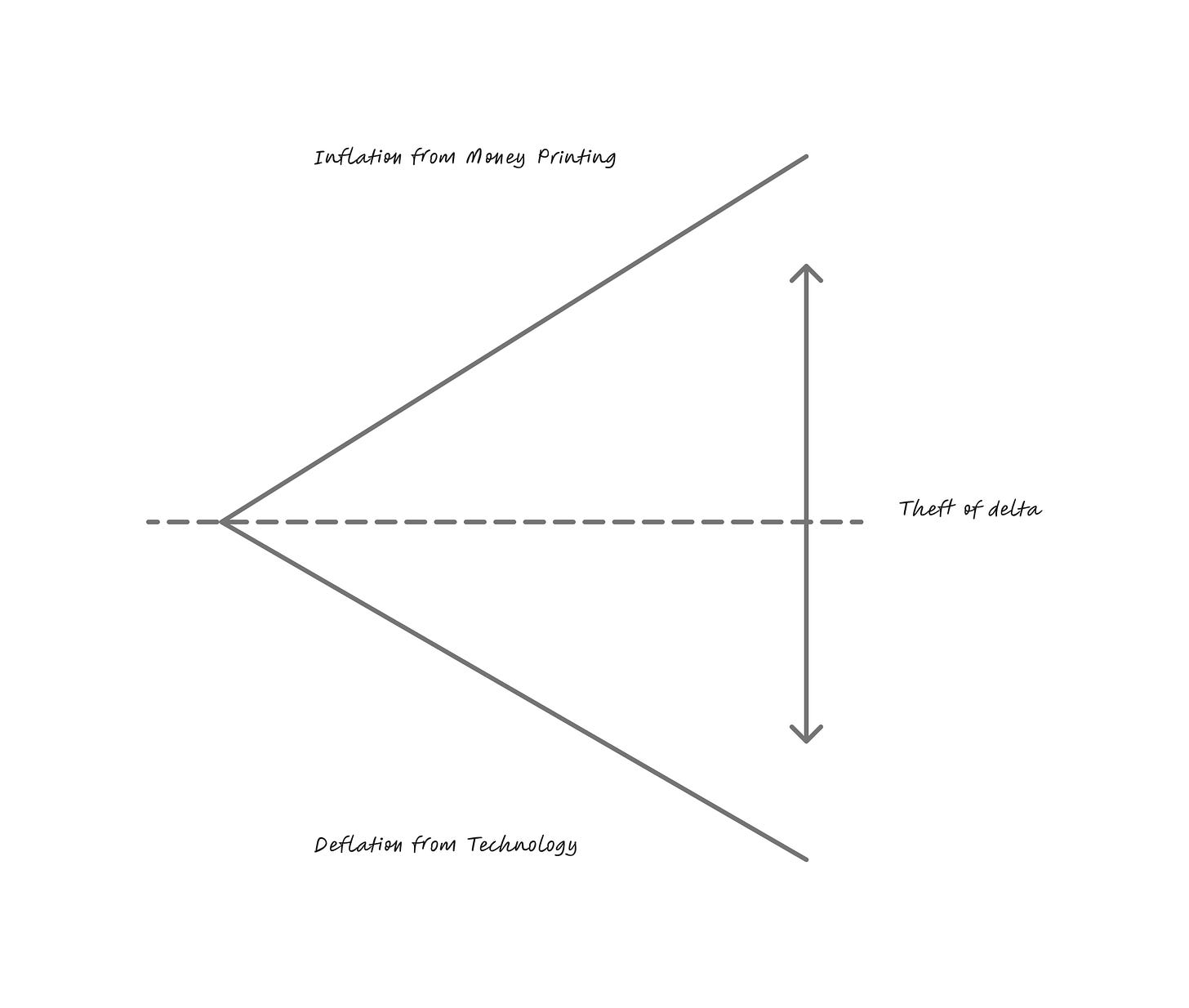

On the flip side - technology works to make things cheaper. It enables greater production with less resources. Technology is deflationary. AI is the mother of all technology. AI will reduce the cost of everything - by a lot.

While technological advancements have made a certain number of things cheaper and more affordable such as flat screen TVs and iPhones - our lives haven’t markedly become cheaper or more affordable.

Not only are Governments enslaving you through inflation - the fact that you never sense deflation or experience the costs of goods getting cheaper means you are getting robbed in two ways.

The illustration above shows the gap between the benefits of reduced costs and the increasing costs from inflation. If you are not seeing the deflationary benefits from the presence of technology in our day to day lives - it would suggest that this value is being siphoned off.

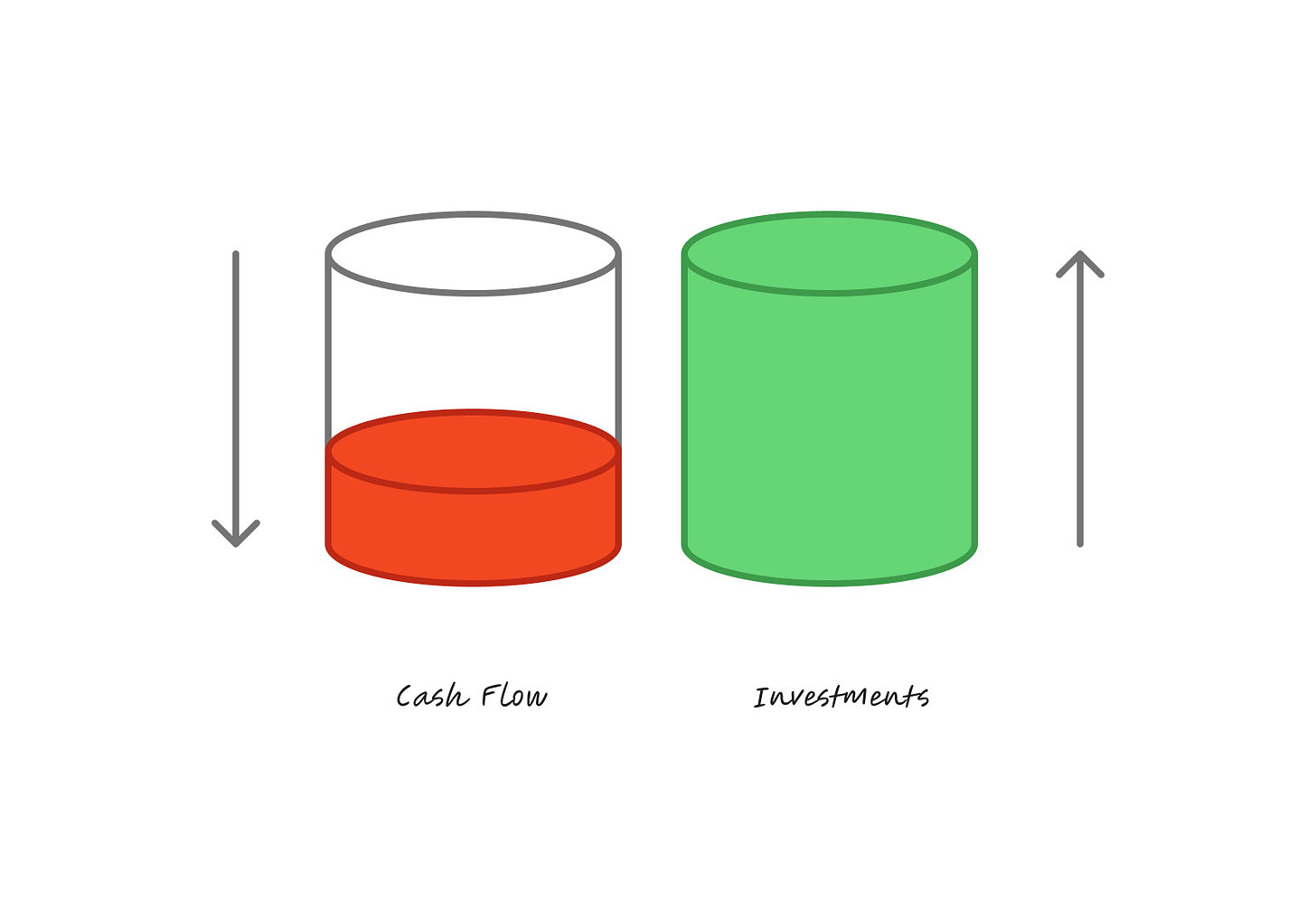

Cash Poor, Asset Rich

Does this diagram resonate with you? It feels like your assets are growing, but find yourself cutting back on day to day costs. Perhaps you aren’t buying steak or quality cheeses or brand name foods.

How can you be rich but also poor at the same time?

This effect strips away the middle class into 2 groups. The wealthy, asset owners and the poors. At some point - society will rise up against a hamster wheel life that spins faster and faster.

At its surface, the destruction of jobs looks like a terrible scenario. However in a world where deflation was allowed to exist in its natural state, jobs displaced by technological improvements are offset by the reducing costs of living.

You might not make half of what you made before, but if the cost of living is half as much then you are OK.

Deflation through technological innovation is stymied by Government intervention and crony corporatism. My guess is that we’ll be given the option of job losses and inflation over job losses and deflation.

Universal Basic Income (UBI)

If AI’s hyper deflation isn’t allowed to manifest, the unemployed masses will demand Governments to steal from the Big Tech companies. This would be in the form of a Universal Basic Income, paying for your cost of living.

I fear the idea of Communist style Universal Basic Income as it would rob people of the will to better themselves and take risk. I’ve heard many stories about modern day Cuba where the inhabitants don’t try to elevate themselves as there is no reward in doing so.

If we are to have AI, we also need the heavy deflation that comes with it. Any other way will expedite the destruction of the middle class.

Job losses from AI and increasing cost of living forces those who may have assets to offload them for cash to make ends meet.

Pay attention to your monthly cashflow relative to your asset values.

I know for certain we're going to see deflation of some things, simultaneously with mass inflation of other things. What we're really going to see is an inversion of value where things that were deemed valuable pre-AI will be worthless, while things deemed worthless will become highly valuable.

The most valuable commodity post-AI is clarity of thought and honest communication.

You are a prime example of this.

You have mastery of written and spoken English and you can read and understand it as your native language.

What AI does, especially in tech, is massively devalue those who don't possess that level of fluency.

AI outputs from broken or unclear prompts produce hallucinations that create logic errors that are extremely difficult to detect - whether it's code, text, images, video or music, it's all the same.

In the tech world, for our entire careers, people like you and I, who are native English communicators have always been devalued. Our jobs outsourced to people who can't communicate naturally in the same language as the end users of the systems we built and tested.

Now with AI, the systems built by people without native fluency in that language will be full of critical bugs that will be impossible to fix without the natural clarity we posses through our English fluency.

Thinking, writing, speaking and understanding English was devalued for decades, and now it's going to be hyperinflated in value in the very near future.