Starting Generational Wealth

How I intend on creating wealth for multiple generations.

Something I’ve been working on is finding Purpose in life. This is something that I’ve been keenly aware of as being missing.

An emergent aspect of enjoyment for me has been education and teaching others. Now I don’t claim to be an expert in anything - but I enjoy learning, digesting, reformatting and relaying knowledge.

Whilst reflecting upon purpose in life - I considered becoming the seed towards multi-generational wealth.

You know I have strong opinions on how the world is setup and how it is designed to keep you down and without options. I’ve always been quite the contrarian and am allergic to being a normie.

The idea of a 60/40 split stocks to options, accumulating wealth over my lifetime then consuming it all, leaving my children with nothing but for them to start the wealth accumulation lifecycle from scratch.

That is how the world is setup. Each generation is set up to be educated until 18, become debt ridden, work their life to pay off that debt, live a little for 10 years and to pass away. Taxes (theft) to be extracted from anything remaining.

Competition

Given the population of the earth, the system of Globalization (thankfully starting to expire) - it is very hard for kids to bootstrap themselves to success.

Clearly populations in India, China have had a rough go trying to make a start for themselves.

Getting an income, getting a house - all of which, I imagine to be a lot harder than it was for me and the generation before me.

Time - The Only Predictable Variable

Given that there are many variables affecting wealth, the only one we can treat as somewhat controllable is time.

If we are deliberate in our action taking, we can take action earlier and for longer.

Given that a core component of Future Value is the number of periods to compound - the longer the time horizon - the more money accumulated.

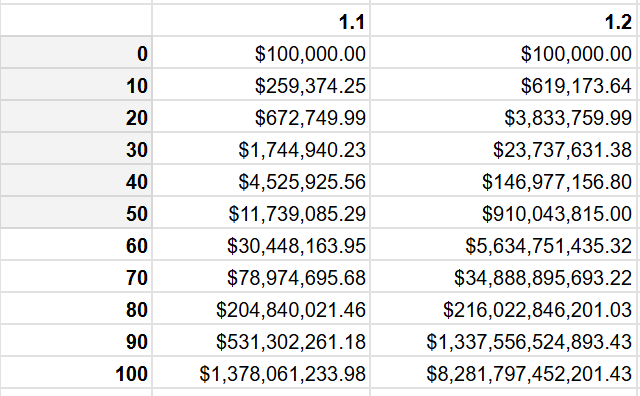

Check out this chart for a time period and returns starting with $100,000. You could read it as someone starting in their twenties or thirties and growing for 50 years. Then passing that over to a new generation (obviously simplified for not withdrawing or taxes).

You can see the effect of time on wealth. We have 10% on the left and 20% return on the right.

Banks - Tools of Slavery

For compounding it makes sense to start investing as soon as you are born.

I was shocked (and later unsurprised) to find out that generally speaking - you can’t create an investment account until a person is 18 years old.

So 1/4 of a persons time horizon has been evaporated.

Evil tools at play by evil people.

If you apply that delay to the chart above - you are looking at only getting 1/10th of the return that you otherwise could have.

Education

I have talked to my children about investing since they were a few years old.

I borrowed from Kevin O’Leary’s description of investing as money soldiers. It’s an intuitive description that kids can visualize.

The money soldiers go off on missions. If they fail they die, if they succeed they bring back bad guys, re-program them then send them all out on new missions. This clicked with my kids so now the focus becomes - what missions are they on.

We’ve reviewed Net Worth and returns across many bed times. The kids remember what the amount was last time, and guess as to how much it would be now.

As they started getting older, I started introducing money to them for their sports activities performance and chores.

They get a flat rate for weekly chores and for competing in their sports. My son gets no money for no results in Soccer. If he performs he gets money. We pre-agree at the beginning of the season what that looks like and he keeps a tally on my whiteboard.

When I pay them out, they take 1/3 of it and put it into investments.

I always ask them to show me on their fingers - ratios.

Wealth

Reflecting upon it - I actually think the kids have a greater Net Worth than most members of both sides of the family.

Not something to boast about - but just a realization.

And its not huge amounts I give them, just the fact that we have it put to use early on and use the Time factor.

Generational Wealth

My intent is to create a multigenerational tight-knit family with clear education, frameworks and morals.

There has been family coats of arms in generations before. However the people who were around during my early years had no family direction or cohesion. We’ll be starting off from scratch, starting with my immediate family.

How does this look?

Well it looks like ongoing nurturing, guidance and support of my children all the way through life. Yes if they turn into horrible human beings - we can reconsider. Until that point, that is the direction I’ll be taking.

This would look like multi generational compound living. This looks like us paying for their vacations. This looks like me helping them with housing, cars and so on. This also looks like giving them money and making them make decisions with it.

I’m keenly familiar with the statistics behind how far wealth typically travels between generations. It’s hard at 2 generations and very unlikely statistically for 3 - so there’s that. But hard things are hard. I’m aware.