Relativity and Measurement

It is purported that Einstein discovered the Theory of Relativity though thought experiments.

You may recall that Thought experiments themselves are one of my favorite ways of modelling the world. A sandbox that is unaffected by constraints of physics. A perfect place to model and experiment.

One of his thought experiments included a scenario of a clock at a Train station and a train.

Whilst being on the train, looking back at the clock one would see the time progress - as expected.

Now as the train picks up speed, you would eventually get to the point where you are going the same speed as the light from the clock travels. The clock would appear to freeze.

As you accelerated past this point, the frames you were observing would appear to go backwards. The observation of time from your RELATIVE LOCATION would appear to go backwards.

Relativity.

You on the train stationary - “time is flowing”

You on the train at the speed of light - “time is frozen”

You on the train faster than the speed of light - “time goes backwards”

Lift and shift the frame of reference

Math was always something I was afraid of when I was younger, but with time and study I grew to love it. It is simple. You just need some reminders as to what the billion rules are - thanks Google and GPT!

Division.

This gives us a way of comparing things one to another. It is the simplest form of measuring relativity. One thing to another.

I’m keen on impressing upon you the notion of you being able to shift your frame of reference. You have the freedom and ability to change your frame of reference to any which that you may choose.

Not just the pre-programmed frame of reference instilled in you by the powers above.

Local Currency as a Reference Point

It has been instilled in us that for us to compare anything in the modern world - we compare it to our local currency.

It is the thing that is stable, ever-present and steady.

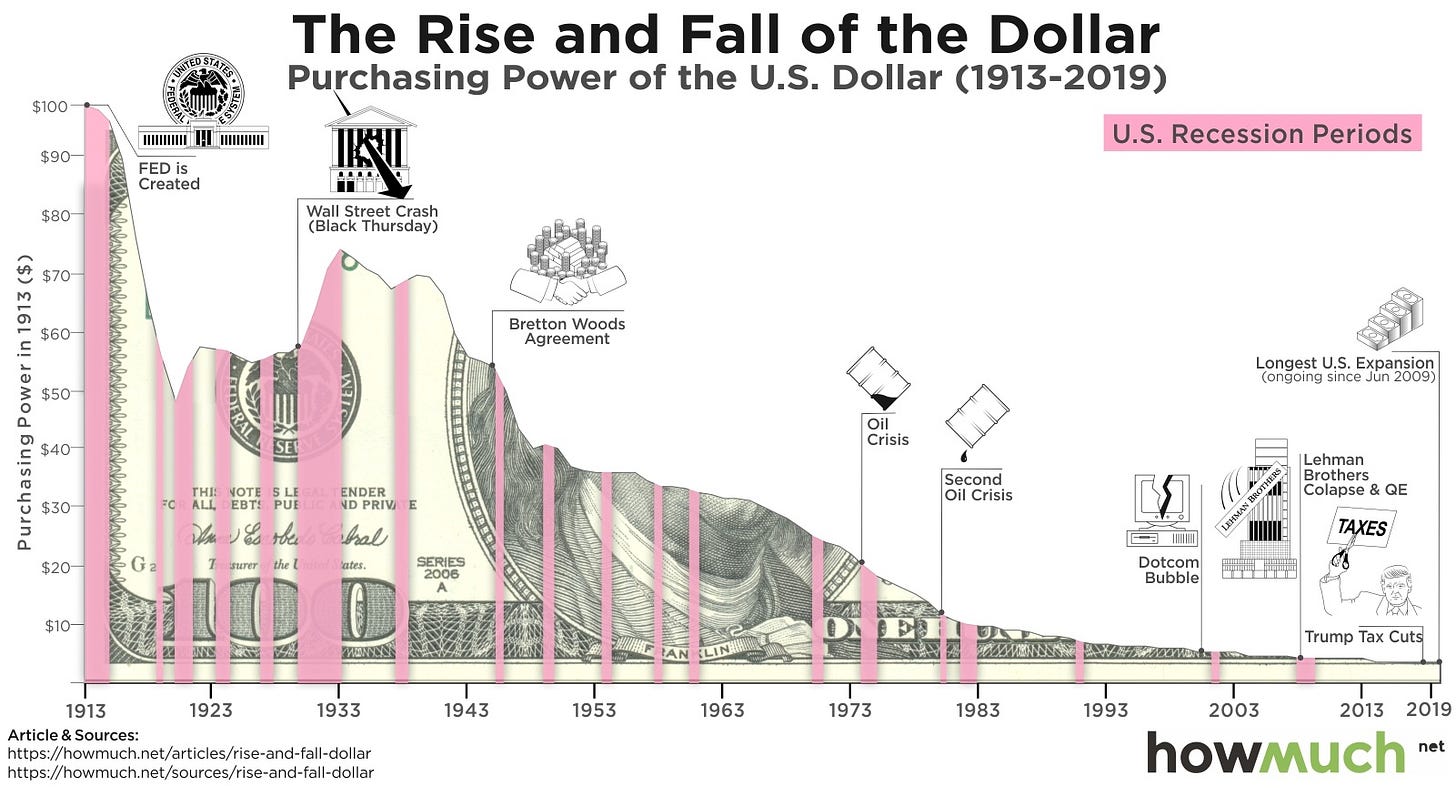

However when we inspect this statement deeply - it is not.

If we compared our hike length to miles - to see whether we were improving our hiking ability - the measure of miles does not fluctuate. It is constant.

If we compared our weight loss to pounds - to see whether we were losing more weight - the measure of pounds does not fluctuate. It is constant.

The British Pound, Australian Dollar, US Dollar, Canadian Dollar, Zimbabwe Dollar - most modern currencies are magically created when Debt is issued. The so called pillar of stability that we measure against is a rapidly dropping level.

Back to Front

We’ve been conditioned to look at the equation upside down. Our riches aren’t going up - the value of the Dollar is going down.

So back in the 70s if a house was $25,000, 1 dollar would be worth 0.00004 houses.

Fast Forward to 2025 - where a house is $500,000, 1 dollar would be worth 0.000002 houses.

The 1 dollar reference point has been the same across these 2 equations, the number of houses has dropped significantly.

This is a 20x drop in the purchasing power of the dollar.

We should be focusing on the constant not the variable for a reference for equality.

We focus on the clock at the train station as it is constant, the trains speed is variable.

The asset is the constant, the dollar is the variable.

Focus on the constant.

Why Use a Shrinking Yard Stick

Why then do we use currency at all for measurement? Imagine having a ruler that changes size each time you use it? Or driving a car where the speedometer is different to yesterday.

You can’t and wouldn’t.

Given that the Debt Based Financial System deliberately creates new currency which deliberately shifts (drops) - we must shed this way of thinking.

A Distorted Price

People traditionally use real estate as a store of value. To the layman - the house bought in the 70s for $25,000 has stored and increased in value to $500,000.

A house has utility value (the value that we put on the use of something) and beyond that any price change is extrinsic to the nature of the house.

If the asset is the constant and the currency is the variable - do we then switch our frame of reference to houses and measure our Net worth in houses? Or 1st edition Spiderman comic books? Or pineapples?

It is clear that the variable should not be the focus but something more stable - perhaps such as an asset. But which asset?

The issue is with pineapples is that they degrade and get squishy.

The issue with Spiderman comics is yes they are rare but the perceived value of these is only with a small number of people in the world. They also rip, fade and break.

Something that is a more abstract store of value, that doesn’t wear down, that has no counter party risk and importantly - something that isn’t inflationary that can be debased by money printing would be ideal.

Bitcoin as the Constant

Doing some deep introspection - it seems silly me measuring my net worth in Monopoly Money.

It feeds into the system of deceit. The illusion of wealth. The game that you can opt out of.

US Dollars are not wealth. They are the chair you sit on in musical chairs that disappears as the game goes on. At the end - no chair.

Going forward I am going to be measuring my wealth in Bitcoin, not Dollars.

When you change your relativity - the price of everything is getting cheaper and cheaper. Which is great!

Wouldn’t you want a world where everything gets cheaper and cheaper! Vacations - cheaper. Ford Mustang - cheaper! Food prices - cheaper!

You can change your frame of reference and the world becomes deflationary.

Who wouldn’t want that - you have the choice.

Perpetuating measuring my wealth in Dollars plays into the system and perpetuates the slavery. If earths population changed their mindset there would be a new deflationary reality.

Similar to a scenario if you had 20 slaves and 1 slave master in Ancient Egypt. If all the slaves colluded, rushed and killed the slave master - they are free. It is just a choice.

I’m going to be measuring my net worth relative to Bitcoin going forward. I’ve not been investing for some time, which effectively means my new Net Worth has been going sideways.

If I look at it from a Dollar point of view it is going up.

However this is disingenuous and a wrong frame of reference to look at it from.

I’m shifting my frame of reference.

This is the way.