Real Estate as an Investment

Boomers selling their house for $1.2 Million Dollars that they bought for a pack of Wrigley’s gum and a high five.

These memes are funny, painful, but funny.

It seems to me though that most people point their anger towards a generation rather than the government. People don’t understand what the government does to steal from people. I’ve listed them here in the article Debt is Slavery.

5 ways to benefit from Real Estate

The misinformed masses point their anger towards the boomers - which I see as a textbook outcome of the government -

to misdirect resentment to anyone but themselves.

Why then are all these “undeserving boomers” “rich”?

Due to some of the 5 factors that make Real Estate a win.

Keith Weinhold an educator whom I highly recommend - the man behind Get Rich Education Podcast highlights the 5 ways here.

Appreciation

Cash Flow

Loan Paydown

Tax Benefit

Inflation

Inflation and Appreciation

2 of these points are directly linked to Inflation. Understanding this is very important. So read, re-read until you understand it.

To the astute investor in a Fiat monetary environment (which most countries are) you become rich by taking on Debt.

Why?

The government “prints” dollars, these find their way into markets, ultimately chasing assets and pushing asset prices higher.

While simultaneously eroding your debt obligation.

A quick bit of Math and my favorite equation:

If we re-arrange for present value

Let’s say we take a $300k (FV) loan for 25 (n) years. If inflation is 3% (r) (which I think it will be way higher over the next 2 decades).

E.g. 300,000 * 1/(1.03^25) = ~$143k

If you never paid back your principle, paid only interest (which was tax deductible) your debt obligation (what you owe) would shrink every year. If you didn’t pay any principle back the Present Value (PV) of $300k is ~$143k.

So you bought something for less than 50% of the cost while getting all the upside growth that comes from Inflation.

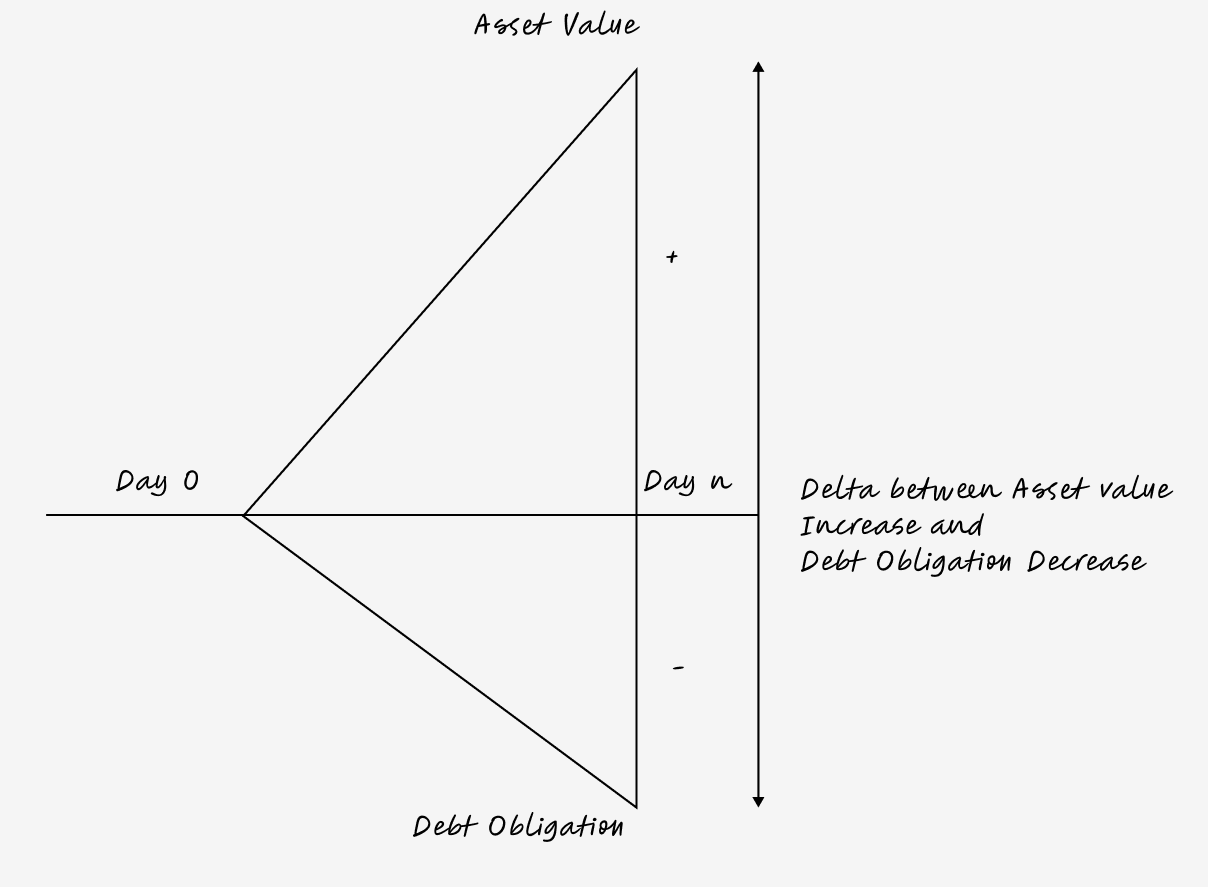

The diagram below illustrates the double positive impact that inflation has on the astute investor carrying debt to buy assets. I had never seen this diagram before or heard it explained this way before, but here you go -

Understand we live in a debt based economic system. It is one of the primary “features” of the system. If you look at the chart above, not including debt in your toolkit reduces your footprint for potential future gains.

Also understand that with debt comes risk. Being over-leveraged during times of economic uncertainty can cause bankruptcy. Lending can dry up, rates can jump up, certain lending types can call for all of a loan to be repaid (less frequent nowadays).

My outlook on inflation is that after governments performative measures recently on curbing inflation (something they create) and given the off the chart levels of debt, they have no choice but to lower interest rates for the next decade(s) until something big and horrible happens.

I visualize the US dollar of being somewhat of a firework. It will shoot up, being the highest performing currency and then suddenly - pop.

Being a keen observer, knowing when to jump off the ride and into real value is the key.

Community Spotlight

Newsletters from other independent thinkers you might find interesting.

👉 Money Machine Newsletter, market beating stocks in a 5 min read. Picked by elite traders. Delivered weekly to your inbox pre-market!

Cash Flow, Loan Paydown, Tax Benefit

These next 3 are more obvious.

Cash Flow is the income you receive above your debt obligations.

Loan paydown slowly increases your equity (or ownership) in the asset over time.

Tax Benefit really is the option to depreciate a property via accounting mechanisms meaning you can opt in for a higher cash flow and reduced tax burden in the present. There are however future consequences via recapture in the future.

My Journey

Looking at my tracking of investments, I have less information on the real estate, but it has returned a CAGR of 35% over a 4 year period. I have been a landlord for around 8 years - but my tracking doesn’t go that far back. I own two rentals, but am looking to expand right away.

When I started off what I was looking at was very different to what I heard on podcasts. None of the numbers looked as good as what they said I should be looking for.

For example I was told I should be looking for cash flow positive opportunities but when I started, the market I was in was really high and cashflow for me as a starter would have been negative $100.

But the way I looked at it, I imagined a thought exercise where someone said, give me $100 and I’ll give you $700 back. To what extent would you play this game? The answer for me was as much as I can.

The $700 was actually loan paydown from the tenant.

So I did this for many years and eventually the properties became cash flow positive.

Running long term rentals should be seen as a business as it is involved and isn’t passive like the stock market. There are headaches and pain. But to me, I’d rather have pain and some ability to affect the outcome than to be unable to influence an investment such as the stock market.

I enjoy the interaction with people, the handiwork and doing something physical. It is a nice contrast to what I do day to day. I’m also a fan of diversification as it fits in with my Wealth Growth Formula.

They say Real Estate has made the most millionaires and I can believe that.

My Next Steps in Real Estate

I am keeping a keen eye to the horizon for end times financial situations from a US default and potential collapse of the US as the reserve currency. This is the fact that keeps me from wanting to over leverage.

One of my education goals for this year was to brush up on the great depression from an economic and financial point of view. One of the most repeated patterns I saw was to stay away from being over leveraged.

Keeping that in mind, I am starting to look at Multi Family real estate to bring in cash flow. Multi family is known for cash flow. I’m now at a point in my life where I want to have more optionality in what I do day to day so cashflow is very important to me now.

If you are interested in seeing what I’m investing in and when, consider becoming a paid member!

Boomers were able to buy real estate so cheap because they were in their 20's when the global monetary system switched from a gold standard to a pure fiat standard in 1971 when Nixon closed the gold window. The US Dollar was the global reserve currency in the aftermath of World War 2, owing to enormous accumulations of gold reserves from warring European countries, so closing the gold window forced every country into a pure fiat standard, something that has never worked in all recorded history of money dating back to when the Chinese first invented it in 900 BC.

After closing the gold window, the value of the US dollar was maintained through brute force, namely in the US exerting force on any country that refused to accept the dollar as a means of bilateral trade. Given that the US military, via the US navy, was the only military capable of securing global trade routes by securing navigable waterways, ensuring global trade, no country could stand up to the US - thus securing the US dollar's role as the global reserve currency.

This strategy is what allowed the US to isolate the Soviet Union and win the Cold War. It was also the justification of every US-led war since the Gulf War in 1990 (none of which the US had definitively won, all of which having turned into enormous wastes of money and human life).

After the collapse of the Soviet Union, however, things started to unravel until we got to where we are today.

Now, the BRICS nations have the military-technological capability to challenge US naval dominance, meaning the US can't secure global trade routes and force nations to use the USD for settlements in bilateral trade by threatening to cut them off from global supply routes.

The reason Boomers in the US dominated trade block were able to enjoy huge levels of appreciation of their real estate assets was because they benefited from grossly imbalanced global trade where instead of having to work and be productive, they could count on their governments forcing other nations into trade subservience.

This means real estate values in the Western world are largely inflated beyond what is reasonable given the productive capacity of Western economies. Our economy is fundamentally underpinned on inexpensive labour, outsourced and offshored to the Global south countries, who must toil in poverty doing every menial, but critical, task no one in the West wants to do.

From mining minerals for our devices, to sewing together the clothes we wear, to making the subcomponents for our advanced manufacturing, to testing and supporting most of our software. All of which we take for granted without understanding that foreigners in poor countries get paid peanuts to do those brutally hard, dangerous, or miserable jobs to produce the essential components that make our entire society work.

The danger, especially in lieu of the emergence of the strength of the BRICS, is that the disruptions to global supply chains coupled with the emergence of a precious metal backed currency (as was proposed this week at the BRICS summit in Kazan) means there could be economic upheavals to a level unprecedented in living memory.

Honestly, I would not be surprised to see real estate values in the West collapse 50-90% in the coming few years as a consequence, and all those "rich" Boomers opting to be euthanized by their government provided doctors.

One thing to remember about the Boomers success in real estate as well is that it was fundamentally underpinned by the assumption that it made sense to be a wage slave from the moment you graduated from high school until the day you were 65. Maybe earlier if you were lucky.

With the currency debasement that emerged as a consequence of the governments elected by the Boomers, the Millennials, Gen Z, and Gen A have no such economic opportunity.

Hence, it is actually fair to blame the Boomers for this mess as well. Western Boomers inherited the most prosperous society in human history in the aftermath of World War 2, and in their lifetimes they've squandered everything for both themselves, their children, and grandchildren.