Futures Contracts, Volatility and Spot Price

How Derivatives Can Be Used For Manipulating Prices

I’ve never seen anything like it.

A one day drop in the price of Silver.

High of ~$118, ~74 $Low.

A ~37% drop in the Spot price of Silver in a single day.

This isn’t Gamestop stock. Half of the world didn’t decide they hated Silver in a single day. A form of money as old as time.

The veil covering market manipulation is falling off.

A lot of my childhood was learning about Good vs Evil. However it seemed like these topics had disappeared from my life as I grew older. They have now come back full force.

2026 is the year I am studying History and Geopolitics. I realize that Corruption and Evil is all around. I won’t say it is overwhelming as that is dismissive, fatalistic and weak. But be sure, its forces are strong in number.

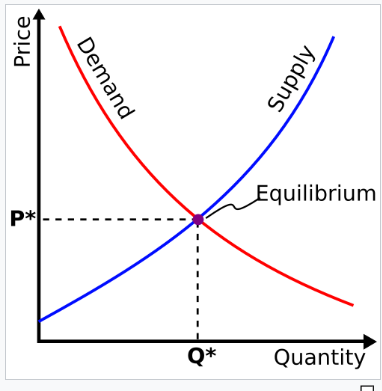

Price

This is the basis of all economics knowledge. The relationship between supply and demand. Price is a function of the interaction between supply and demand. Too much supply and same demand - prices down. Too much demand and same supply - prices up.

The Evil of Abstraction - Derivatives

You may have heard of Derivatives - they are an abstraction on an underlying fundamental. Effectively a casino that allows for bets of any which way and means.

Common ones are the Futures Market and the Options Market. Others include Swaps, Forwards and Structured Products (There are more…).

Futures - A futures contract is an obligation, not a right, to buy or sell the underlying asset at a fixed price on a fixed future date.

Option - An option is a right, not an obligation, to buy or sell an underlying asset at a fixed price before or at a set date.

Derivatives are somewhat like apparitions. Something from another realm that can come in and influence our decisions without being on the same physical plane.

Imagine If You Will

Imagine if you will - taking the following steps:

Print money - Fiat system allows for magick money!

Use that money to sell shorts on the Futures market for <Fill in your Commodity>

These appear as selling pressure for the future - remember our supply and demand curve? Now the true price is heavily distorted

Should the prices increase against the will of those trying to suppress the market?

Given that money is free to those who make it. They just sell the contract at a loss (it could be 1 cent) in order to stay within the realm of cash and not go into the underlying physical commodity.

The price/money/cash is not the thing of importance here.

It is the suppression of the underlying physical asset being targeted.

Grok

Grok is a GPT that is more relaxed when asking questions that want to be kept from the public’s viewpoint.

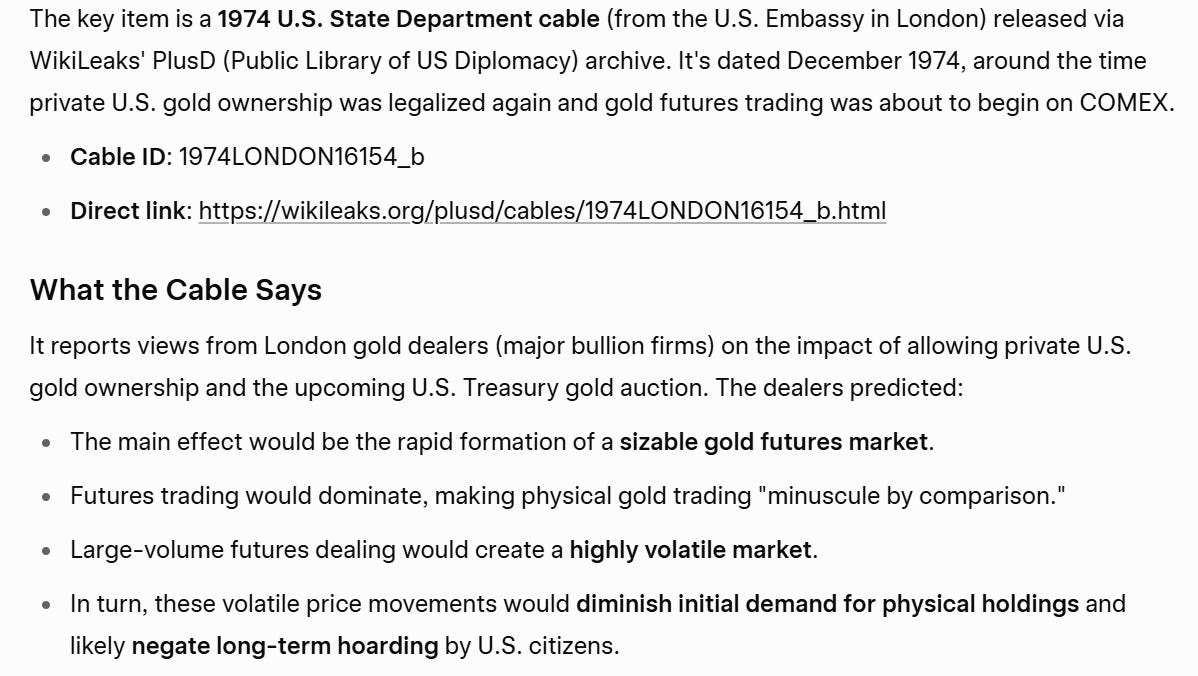

I am familiar with a historic cable (around the time private US gold ownership was legalized again) touting the introduction of a futures market and its role in manipulating volatility and price action. See below:

Gold, Silver, Bitcoin

All distinct potential stores of value. Distinct competitors to the USD.

Did you know -

They allowed a Futures market for Bitcoin 6 years before they allowed a public Bitcoin market?

Their pushback on Bitcoin market was painted with protecting the public from manipulation.

“Financial weapons of mass destruction.” - Warren Buffet, describing Derivatives

The exact same thing happened in silver in May 2011. It dropped 30% in one day the day after Osama Bin Laden was killed and 40% in 15 seconds in September that year. That's why I developed the tranche strategy I discussed in one of your previous posts, having pre-determined GSR ratios to swap silver to gold, knowing the silver price is prone to those rapid price swings. If you bought at a GSR of 120 at the start of the COVID lockdowns, swapping from 75-55 in regular, pre-determined intervals removes the emotion, both of price spikes and crashes.

That said, I've known every since 2011, and later when I worked at one of the largest financial futures exchanges on the planet that derivatives set the price of everything on the planet from oil, to orange juice, to silver - and that all market pricing is determined on the futures markets. That same exchange was one of the first that launched Bitcoin futures while I was working there and why I never got back into crypto after.

That's what caused the Global Financial crisis of 2008. Mortgaged Backed Securities traded on the derivatives market and institutional actors liquidating their positions in a way that caused cascading margin calls as leverage on those positions caused exponential losses as the underlying prices of those securities dropped.

The ones with insider information who sold BEFORE the market caught on made out like bandits, while the entire global financial system essentially crashed and needed to be bailed out by the US government.

The idea of free-market capitalism died back then, and we've been living in a derivatives mirage, where the institutional "TBTF" who own the derivatives market basically set the price of everything - irrespective of inconvenient things like supply and demand dynamics of the underlying physical commodity.

It's been a surreal 18 years...